🔥 This offer expires in:

🔥 This offer expires in:

+1 000-000-000

For Ambitious People Who Want To Build Credit, Multiply Cashflow, and Unlock Funding

Fix Your Credit, Leverage MS to Generate Income, Travel the World for FREE, & Secure Funding with the 4 in 1 System That’s Already Helped 20,000+ People Take Control of Their Finances

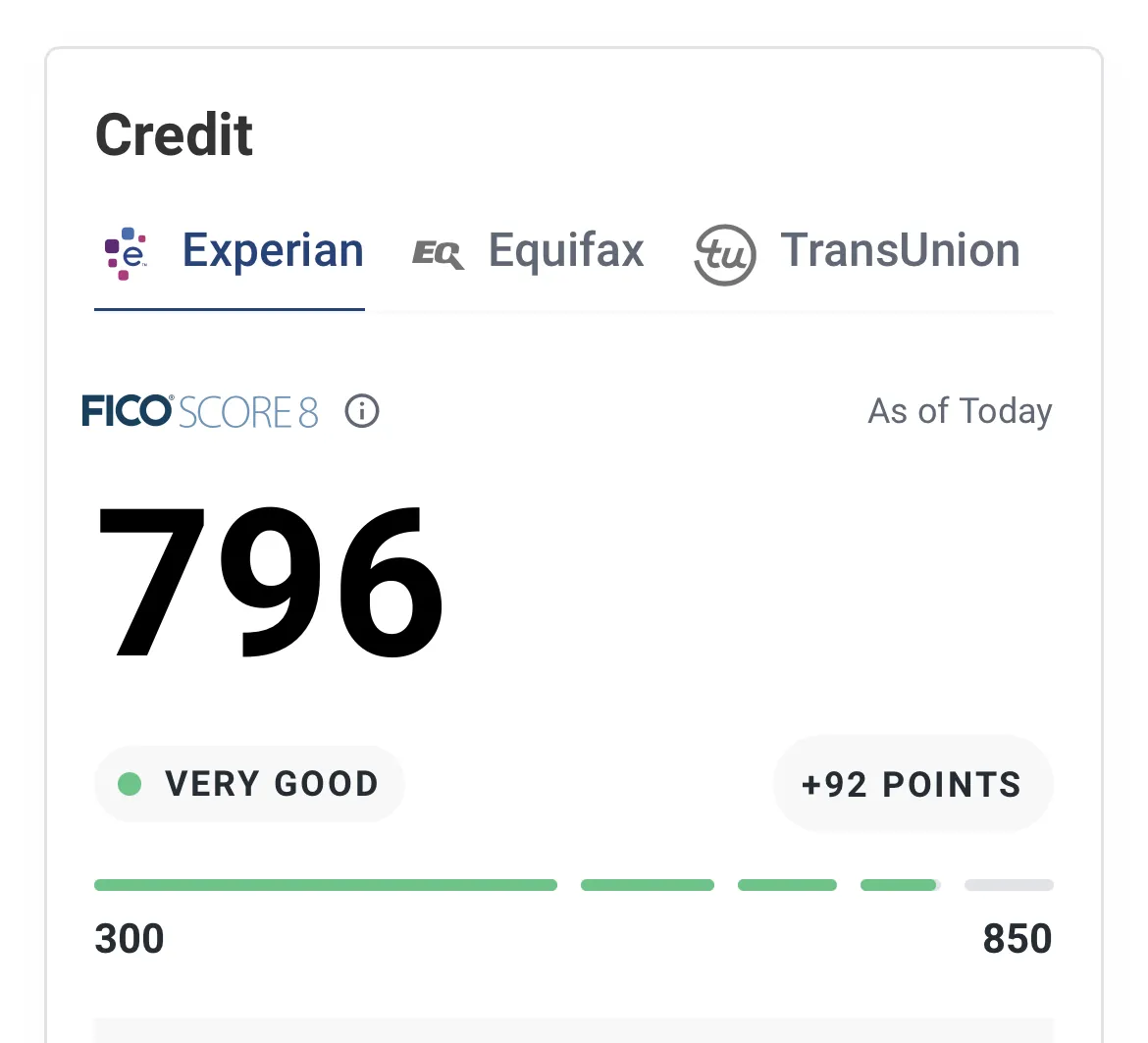

In as little as 90 days you’ll have the structure banks look for. Learn how to build your credit the right way, flip plays that put money back in your pocket, and unlock high-limit funding that banks never tell you about while saving time, stress, and thousands of dollars

4.8 / 5 based on 1,931 reviews

JOE NORRIS

TEACHER & DAD OF 3

I was utterly lost before simply keeping money in bank, odd investment app and paying hidden fees left right and center. I had no idea how the 'systems' truly worked but now it seems so obvious. Getting this full guide was a game changer and I saved the cost of it in one decision, plus now kick started my self education journey so I'm the one in control.

INTRODUCING THE UNDERCOVER INVESTOR

Banks Are Saying No to Nearly 50% of Credit Requests. Use the System That Gets Them Saying “Yes.”

Every year, thousands of people get denied, low-balled, or stuck paying high interest because their profile isn’t structured the right way. You might think paying bills on time is enough, but banks are looking at way more than that.

Without the right setup, your credit works against you while banks keep profiting off your missed approvals and higher rates.

This bundle gives you the blueprint. Inside, you’ll learn how to repair and structure your credit for maximum approvals, leverage manufactured spending strategies to turn credit into real income, and access the personal and business funding banks rarely hand out to the unprepared.

It’s time to move from confused borrower to confident player with strategies that don’t require being an expert, only the right knowledge and the willingness to apply it.

Build True Credit Structure

Most people think paying bills on time and adding credit builders is enough, but banks look for way more. This guide shows you how to build a profile that’s actually fundable, so you can qualify for high-limit approvals instead of denials.

Unlock Strategies the Top 1% Use

The wealthy don’t just save money — they move it. Learn the same manufactured spending and funding strategies the top 1% rely on to multiply cashflow and keep banks working for them, not against them.

Leverage 5–10X More Than Your Limits

Banks lend 5–10X more than what’s sitting in your account, and you can do the same when you know how to use credit properly. We’ll show you how to turn small limits into major approvals without wasting inquiries.

Power Plays in Under 5 Minutes

Lock in moves that banks don’t expect: freeze a bureau before you apply, request an instant credit limit increase, or drop funds into a pledge loan to boost your profile. These quick plays stack up and put you in position for approvals fast.

STEP ABOVE THE CROWD

What keeps most people stuck is what sets you apart...

While everyone else is relying on bad credit, guessing at funding, or stuck in debt, you’ll have insider strategies the top 1% use. This 3-ebook bundle gives you the tools to separate yourself and take control financially.

Why You Need More Than Just Credit Builders…

Here's the content:

Part 1: How to structure your profile so banks take you serious

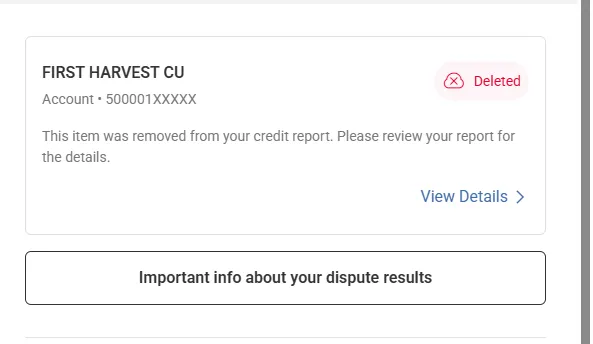

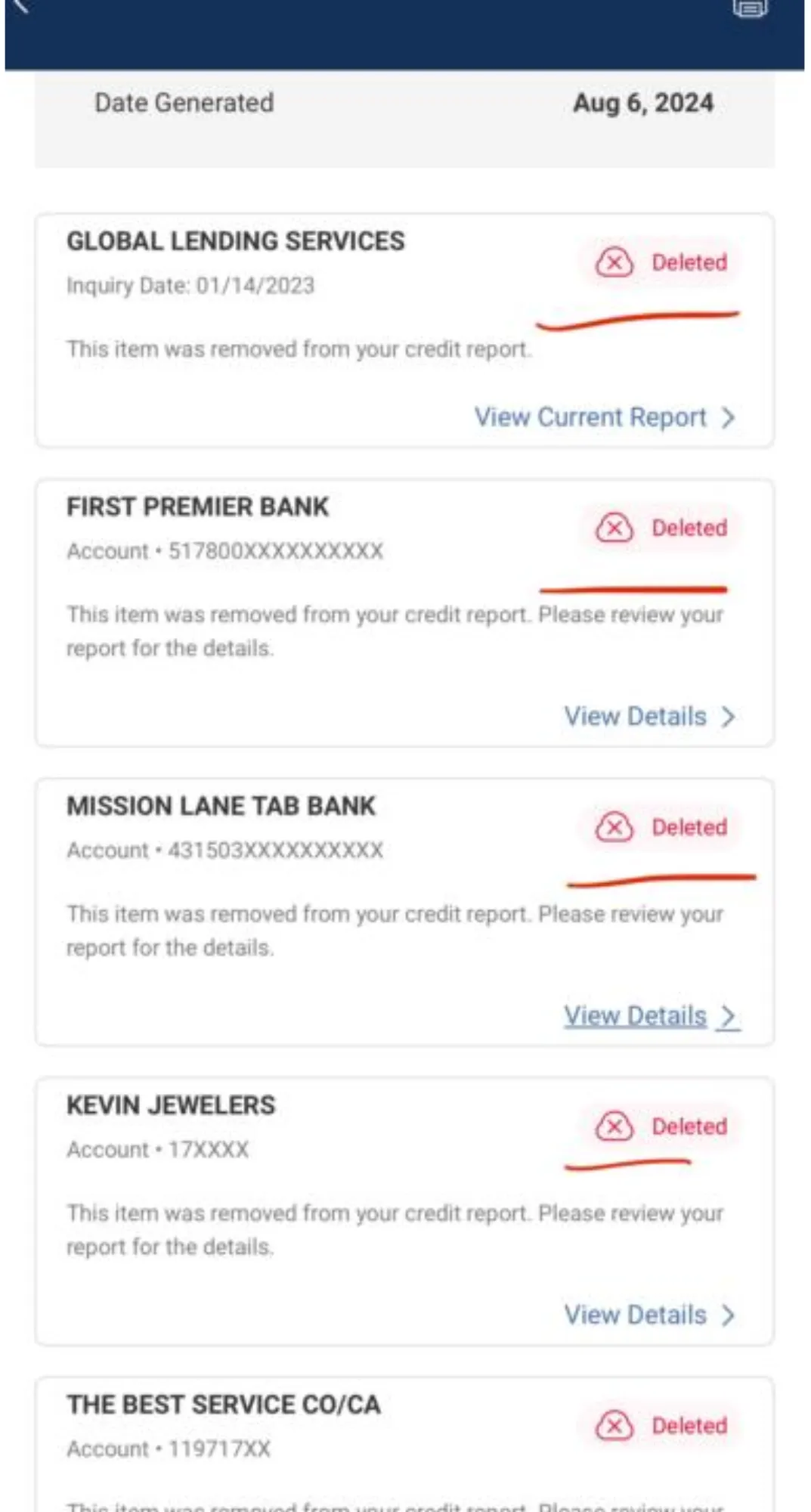

Part 2: The right way to remove negative accounts

Part 3: Why builder accounts aren't enough to unlock funding

How The Top 1% Turn Credit Into Cashflow...

Here's the content:

Part 1: The truth about manufacture spending and why it works

Part 2: Simple plays you can run today to create income

Part 3: How to avoid shutdowns and red flags banks look for

The Financial Freedom Formula...

Here's the content:

Part 1: What banks really look for in an application

Part 2: How to stack approvals without wasting inquiries

Part 3: Personal and Business funding hacks that multiply results

OVER 20,000+ PEOPLE HAVE USED THESE EXACT STRATEGIES. GET OVER $1,997 WORTH OF PROVEN CREDIT & FUNDING STRATEGIES FOR JUST $97!

4.8 / 5 based on 1,931 reviews

Exclusive Bonuses Just For YOU!

Along with your ebook bundle, you’ll get special bonuses designed to make the plays even easier to apply. These extras save you time, keep you on track, and give you an edge most people never have.

BONUS 1: Credit Repair Resource Vault

A hand-picked list of dispute codes, templates, and insider tools to make fixing your credit faster and more effective.

BONUS 2: Bank Audit Question Sheet

Know exactly what to ask before opening accounts or applying for funding — walk into any bank with confidence.

BONUS 3: 90-Day Funding Checklist

Step-by-step action plan to make sure you’re structured and ready for high-limit approvals within 90 days.

BONUS 4: MS Quick-Start Guide

Easy manufactured spending plays you can set up in minutes to start generating cashflow without risk.

BONUS 5: Funding Sequence Map

A visual roadmap that shows you which banks to hit in what order, so you don’t waste inquiries and maximize approvals.

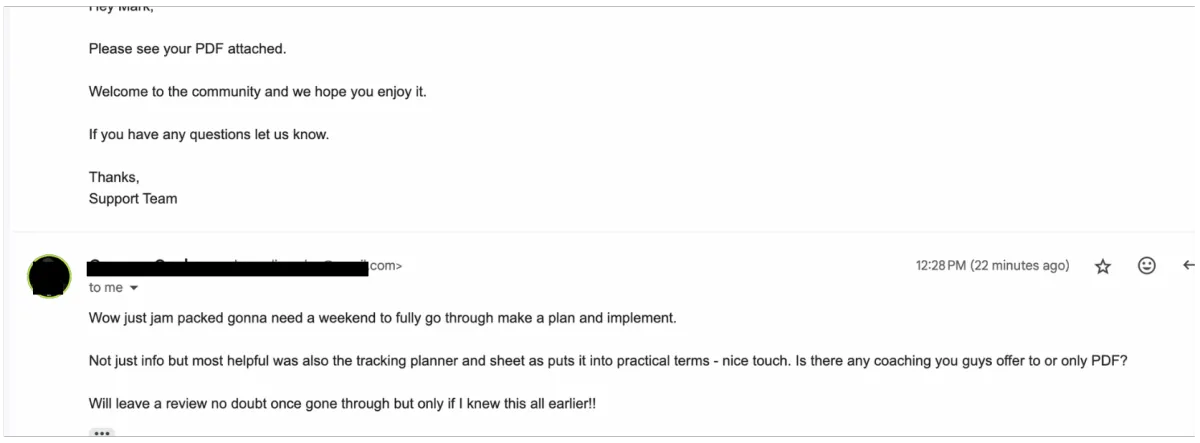

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

Verified Review

SARAH LEWIS

Small Business Owner

"I always thought I was being smart—saving money, paying down debts... but this guide blew my mind. Turns out, there’s way more I could be doing to actually grow what I have. It’s crazy. I’m making moves now that I didn’t even know were possible. Already seeing the benefits, and it’s been worth every cent."

Verified Review

DAVID CHEN

Engineer & Investor

"Always wanted to take charge of my finances but felt like it was just... too much info out there, you know? This guide just lays it all out, step by step. Now my money’s actually working FOR me instead of just sitting in a bank. One month in, I’m already seeing more growth than years of just ‘saving’ ever did."

Verified Review

EMILY REED

Freelancer & mom of 2

"Bank fees, low interest rates... basically, my money was just stagnant. I didn’t even realize how much of a trap I was in till I read this. Just one of the decisions I’ve made from this guide saved me what it cost, honestly. It’s like I finally got control over my own money. Total game-changer."

Verified Review

ROBERT MARTIN

Self-employed entrepreneur

"I used to feel, well... totally clueless about investing and where to start. Then I got this guide, and boom—direction. It’s like having a road map for my money. My biggest regret? Not getting this sooner. Seriously, if you’re looking to break out of that paycheck-to-paycheck cycle, this is it."

Verified Review

JASMINE PATEL

College student & part-time worker

"People always say, ‘Just save your money!’ but no one ever tells you HOW to actually make it grow. This guide changed that. I’m starting small but even now I can see the difference it’s making. For the first time, I’m actually excited about my finances!"

Verified Review

MICHAEL GONZALEZ

Marketing professional

"I’ve been stuck in the traditional banking loop for years, just assuming it was safe and smart. Wrong. This guide opened my eyes. I’m now actually seeing my money do something other than sit there gathering dust. If you’re on the fence, get off it and grab this. It’s already paid for itself, trust me."

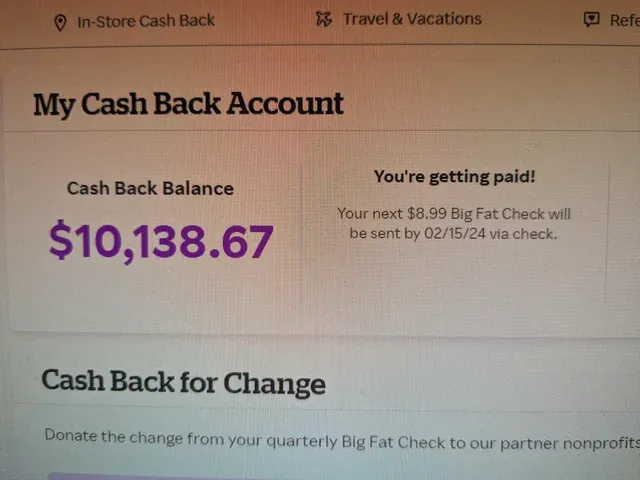

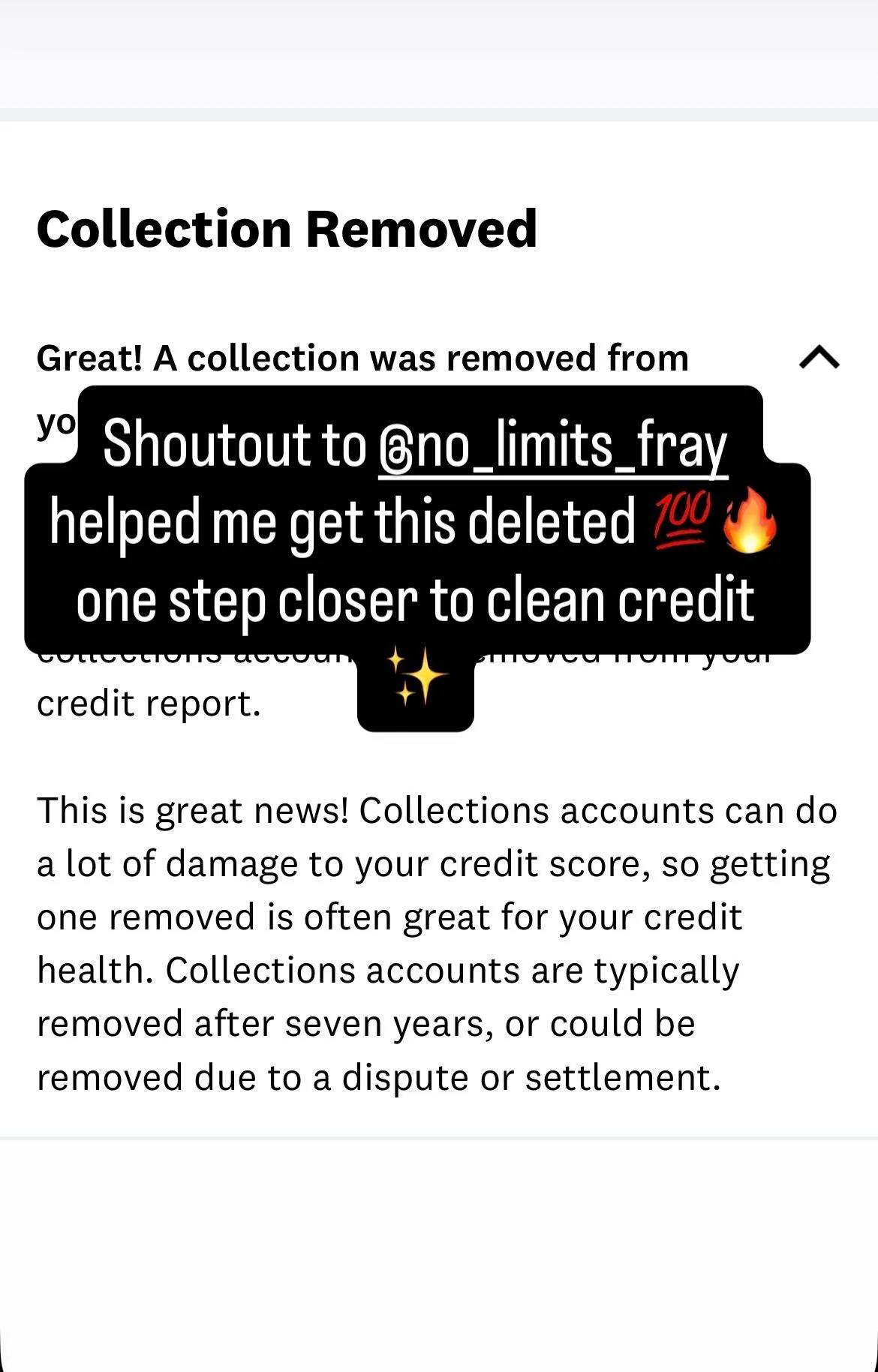

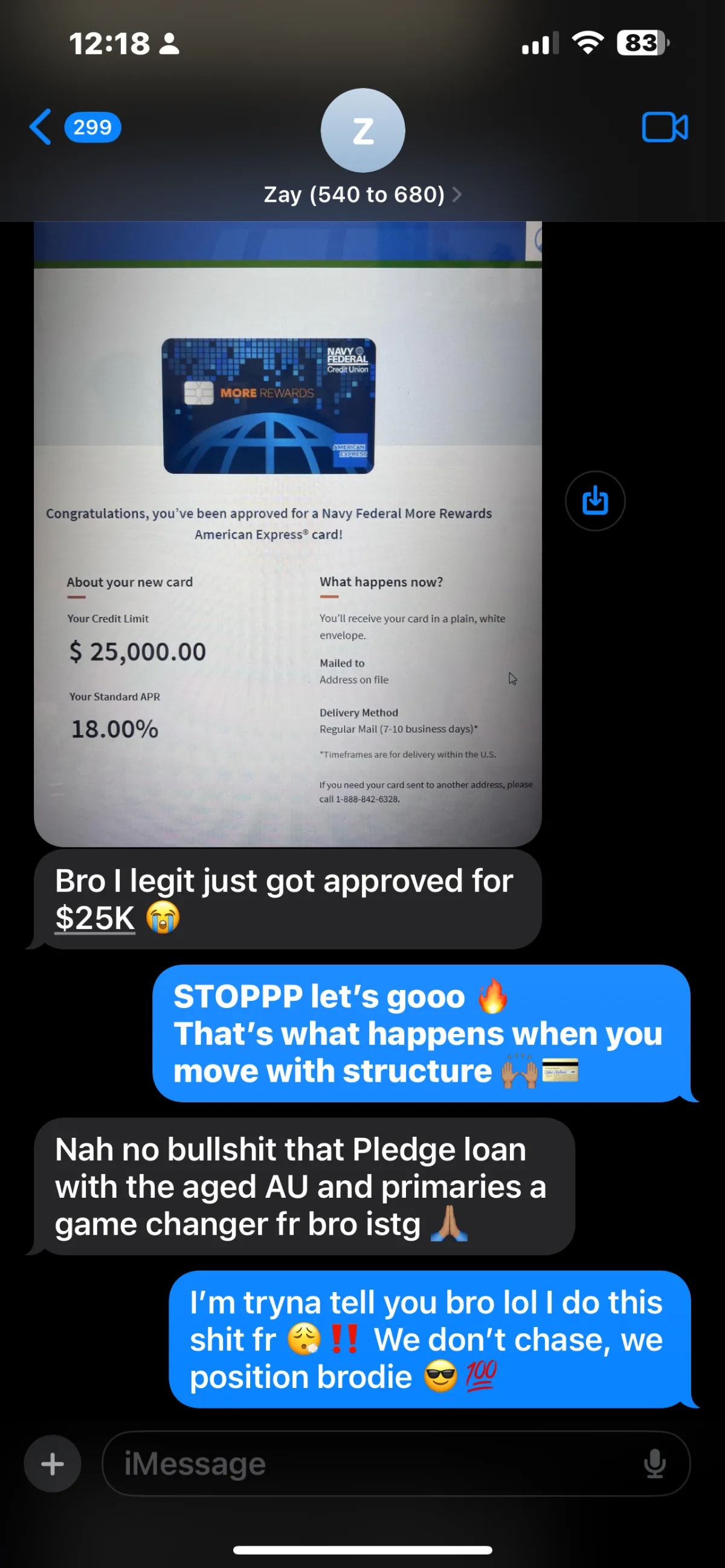

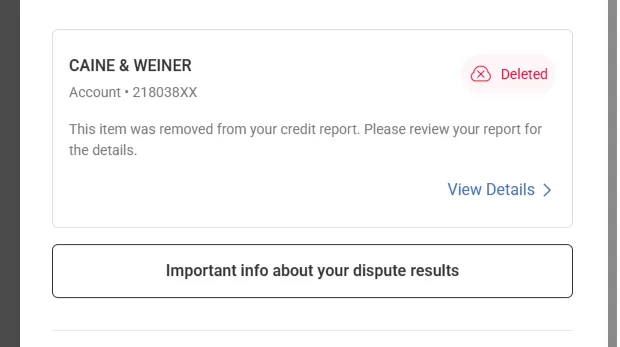

Want More? People Just Like You Send Us In This Everyday...

4.8 / 5 based on 1,931 reviews

READY TO LEVEL UP YOUR FINANCES?

Get The 3-IN-1 CREDIT, MS, & FUNDING BUNDLE Today!

With the bundle, you gain immediate access to invaluable resources on insider strategies that fix your credit, generate income through manufactured spending, and unlock high-limit funding. For a limited time, grab this comprehensive package at an unbeatable price. Don’t miss this chance to transform your future and join the top 1%.

CREDIT • MS • FUNDING BUNDLE

VAT/Tax Include

4.8 / 5 based on 1,931 reviews

BONUS 1: Credit Repair Resource Vault

A hand-picked list of dispute codes, templates, and insider tools to make fixing your credit faster and more effective.

BONUS 2: Bank Audit Question Sheet

Know exactly what to ask before opening accounts or applying for funding — walk into any bank with confidence.

BONUS 3: 90-Day Funding Checklist

Step-by-step action plan to make sure you’re structured and ready for high-limit approvals within 90 days.

BONUS 4: MS Quick-Start Guide

Easy manufactured spending plays you can set up in minutes to start generating cashflow without risk.

BONUS 5: Funding Sequence Map

A visual roadmap that shows you which banks to hit in what order, so you don’t waste inquiries and maximize approvals.

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This bundle walks you through proven strategies to repair and structure your credit, leverage manufactured spending to create income, and unlock both personal and business funding. You’ll learn step-by-step plays that the top 1% use but banks never tell you, so you can position yourself for approvals, grow your profile, and finally use credit to your advantage.

Is this guide suitable for beginners?

Yes — it’s designed to work for anyone, even if you’re starting from zero. Everything is broken down in plain language with step-by-step instructions.

Do I need a large amount of money to start?

No. Many of the strategies inside can be applied with little to no upfront capital, since we’re leveraging OPM (other people’s money). Plays like pledge loans or small MS runs can start as low as $500–$1,000, but often you won’t need to use your own funds at all. As your profile and approvals grow, you’ll be able to scale without draining your pockets.

How quickly can I see results?

Results vary, but many people start seeing improvements within 30–90 days as their credit profile strengthens and they position for approvals. The faster you implement, the sooner you’ll see changes.

Will this guide work for me if I’m already investing?

Yes. Even if you’re already investing, strong credit and access to funding multiplies your opportunities. The strategies here are about leveraging other people’s money (OPM) so you can go further, faster.

What resources come with the guide?

You’ll receive 3 eBooks covering credit repair, manufactured spending, and funding strategies, plus bonus resources like checklists, bank audit questions, and funding maps to make applying the plays easier.

How is this different from free advice I can find online?

Free advice online is usually incomplete, outdated, or designed to keep you guessing. This bundle gives you tested, proven strategies in one place, saving you time and helping you avoid costly mistakes.

Is there a guarantee if I’m not satisfied?

While we can’t offer refunds on digital products, we’re confident in the value this guide brings. The strategies inside are designed to help you save and grow your money—many users report getting more than their money’s worth within days of implementing the tips. Just by applying even one of the manufactured spending strategies, most people can generate enough income in 30 days to cover the cost of the entire bundle (and then some).

4.8 / 5 based on 1,931 reviews

All rights reserved © 2025 BetterMe Financial.

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.